SPOILER ALERT!

How to cut down the process and timeline when anyonefile application for Immigrate to USA with EB5 program by property purchase

Article created by-Whitehead Melendez

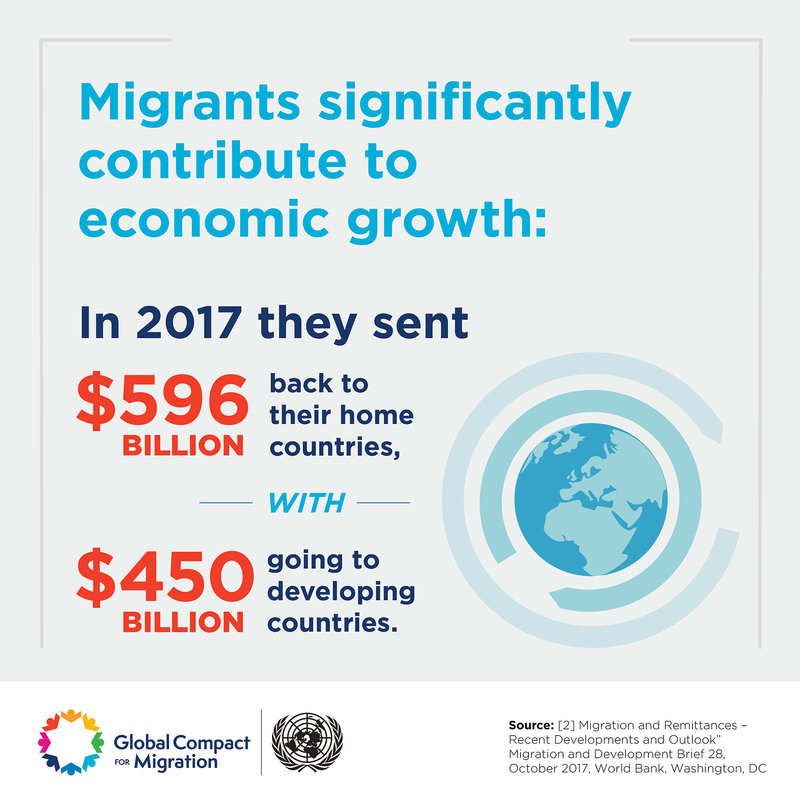

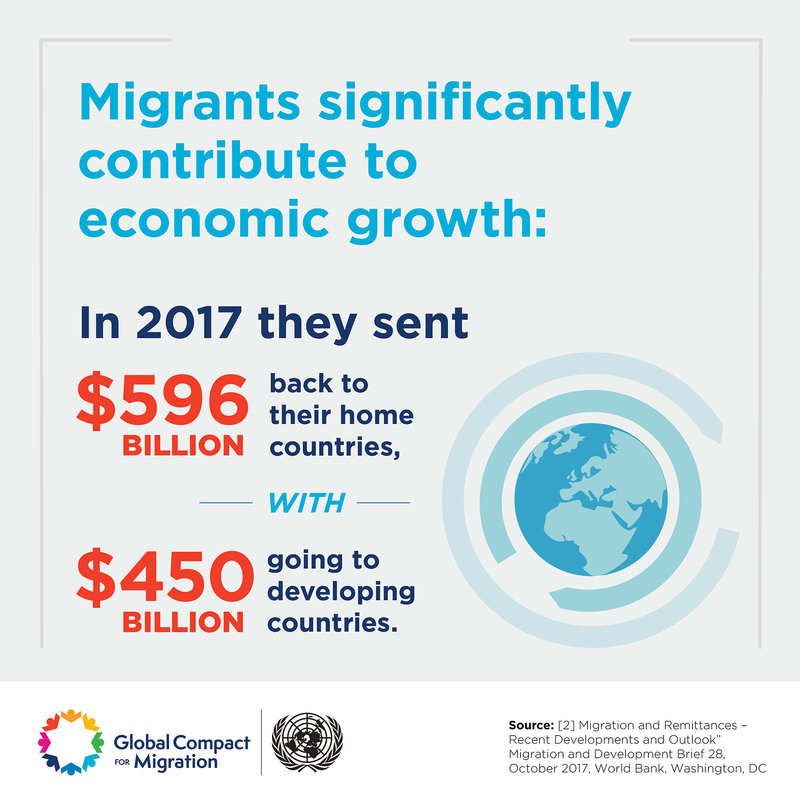

The USA EB5 Visa, employment-based foreign money financier program, designed in 1990 by the Migration Act of 1990, supplies a system for eligible Immigrants to become eligible for a permanent residence in the United States. The key goal is to boost the quantity of Immigrants and also International experts who can add to the economic growth of the USA while capitalizing on our economic system. Over three million people are now lawfully present in the USA as the outcome of the Migration Reform as well as Control Act of 1996. The USA Federal government has an overall goal of confessing a majority of these individuals each year right into the nation, consisting of those that are eligible to receive an immigrant visa and also those that have already developed theirutations in the USA.

The primary incentive for investors to benefit from the EB5 Visa possibility is that there are no restrictions on investment or sale of this visa. Unlike various other financial investment options, the investment in the United States with the EB5 Visa is not limited by the nature of work or home. A person may be needed to satisfy some conditions, nonetheless, if he/she wants to take advantage of the investor program. These problems, if they are not satisfied, might lead to the denial of the visa. Additionally, there are steps take into location to make certain the honest treatment of all applicants.

The requirements that are necessary to make use of the opportunity depend on the type of financial investment you are seeking to make. If you are intending to make an investment in a foreign country, you should invest at the very least 10% of your individual possessions as cash money or investment resources. In addition, you must utilize or seek the services of a foreign investment professional that is authorized to give help to individuals that want the immigration program. There are specific investment areas that call for particular types of investments.

Entrepreneurs are frequently the ones most curious about the chance of investing with the EB5 Visa. Therefore, there specify https://s3.amazonaws.com/united--states/eb-5-visa.html for these financiers. One of these opportunities remains in the business field. Business owners are able to obtain the assistance and suggestions of these financial investment advisors, which might prove to be important to their service.

Company advisors who become part of the program should stick to certain moral criteria stated by the USA Department of Commerce. As part of their responsibilities, these advisors have to perform detailed due diligence on the prospective investment. They have to validate a firm's qualifications, specifically with respect to their licensing status. Additionally, they should be able to establish a connection with a foreign organization entity. This connection may verify beneficial in getting a car loan from the United States Department of Business for investment purposes.

Investment advisers that are part of the program need to additionally guarantee that their customers satisfy the financial investment credentials set forth by the USA Department of Commerce. To do so, these capitalists should finish a F-1 visa application. https://www.eb5daily.com/2020/06/latest-eb-5-immigrant-petition-by-alien-investor-i-526-data/ for investors that are not United States residents can be a lengthy one. Nevertheless, it can be worth the moment financial investment, as the program helps foreign business owners in obtaining a foothold in the United States.

When looking for a financial investment visa via the EB5 Visa, an investor has to likewise ensure that she or he comprehends the laws and also policies regulating the country. For instance, a company that wants to purchase building in the USA need to register its rate of interest with the IRS. This enrollment is called for even if the financial investment is just to acquire real estate in the United States. International investors should additionally recognize how the legislation works when it comes to property taxes. A financier may not be eligible to obtain a United States visa if she or he has actually not provided financial info that follows the regulation.

Finally, investment consultants should keep in mind that the economic statements they submit to the Department of State should be sustained by documents. If the financier submits false details, he or she might undergo migration charge. As a financier, you require to understand that if the United States government locates misrepresentation or false information throughout your visa meeting, then you could shed your capability to work in the country. So, it is really essential that you gather all of the paperwork you need before sending it for authorization. Or else, you can squander your money and time obtaining an investment visa authorized and then having it rejected.

The USA EB5 Visa, employment-based foreign money financier program, designed in 1990 by the Migration Act of 1990, supplies a system for eligible Immigrants to become eligible for a permanent residence in the United States. The key goal is to boost the quantity of Immigrants and also International experts who can add to the economic growth of the USA while capitalizing on our economic system. Over three million people are now lawfully present in the USA as the outcome of the Migration Reform as well as Control Act of 1996. The USA Federal government has an overall goal of confessing a majority of these individuals each year right into the nation, consisting of those that are eligible to receive an immigrant visa and also those that have already developed theirutations in the USA.

The primary incentive for investors to benefit from the EB5 Visa possibility is that there are no restrictions on investment or sale of this visa. Unlike various other financial investment options, the investment in the United States with the EB5 Visa is not limited by the nature of work or home. A person may be needed to satisfy some conditions, nonetheless, if he/she wants to take advantage of the investor program. These problems, if they are not satisfied, might lead to the denial of the visa. Additionally, there are steps take into location to make certain the honest treatment of all applicants.

The requirements that are necessary to make use of the opportunity depend on the type of financial investment you are seeking to make. If you are intending to make an investment in a foreign country, you should invest at the very least 10% of your individual possessions as cash money or investment resources. In addition, you must utilize or seek the services of a foreign investment professional that is authorized to give help to individuals that want the immigration program. There are specific investment areas that call for particular types of investments.

Entrepreneurs are frequently the ones most curious about the chance of investing with the EB5 Visa. Therefore, there specify https://s3.amazonaws.com/united--states/eb-5-visa.html for these financiers. One of these opportunities remains in the business field. Business owners are able to obtain the assistance and suggestions of these financial investment advisors, which might prove to be important to their service.

Company advisors who become part of the program should stick to certain moral criteria stated by the USA Department of Commerce. As part of their responsibilities, these advisors have to perform detailed due diligence on the prospective investment. They have to validate a firm's qualifications, specifically with respect to their licensing status. Additionally, they should be able to establish a connection with a foreign organization entity. This connection may verify beneficial in getting a car loan from the United States Department of Business for investment purposes.

Investment advisers that are part of the program need to additionally guarantee that their customers satisfy the financial investment credentials set forth by the USA Department of Commerce. To do so, these capitalists should finish a F-1 visa application. https://www.eb5daily.com/2020/06/latest-eb-5-immigrant-petition-by-alien-investor-i-526-data/ for investors that are not United States residents can be a lengthy one. Nevertheless, it can be worth the moment financial investment, as the program helps foreign business owners in obtaining a foothold in the United States.

When looking for a financial investment visa via the EB5 Visa, an investor has to likewise ensure that she or he comprehends the laws and also policies regulating the country. For instance, a company that wants to purchase building in the USA need to register its rate of interest with the IRS. This enrollment is called for even if the financial investment is just to acquire real estate in the United States. International investors should additionally recognize how the legislation works when it comes to property taxes. A financier may not be eligible to obtain a United States visa if she or he has actually not provided financial info that follows the regulation.

Finally, investment consultants should keep in mind that the economic statements they submit to the Department of State should be sustained by documents. If the financier submits false details, he or she might undergo migration charge. As a financier, you require to understand that if the United States government locates misrepresentation or false information throughout your visa meeting, then you could shed your capability to work in the country. So, it is really essential that you gather all of the paperwork you need before sending it for authorization. Or else, you can squander your money and time obtaining an investment visa authorized and then having it rejected.